During the Summer of 2015, I received a design fellowship at Blue Ridge Labs - a social impact technology incubator - to research and create technology for underserved communities in NYC. I was paired with product guru - Alex Hunsucker - and coding extraordinaire - Fred Diego. In just three months we performed over 25 one-on-one interviews, 3 focus groups, multiple field surveys and testing in order to ideate and create our prototype focused on helping low income students with college costs.

Our Solution

Duckling provides little loans to college students to cover the hidden costs of higher education. Using lending circles and simple loan terms through a mobile interface, Duckling provides a low-risk option to pay for costs that threaten to derail their education.

Why it Matters

While students spend years preparing for college, most do not anticipate the extra costs of higher education. In fact, tuition accounts for only 38% of an education, with other expenses coming from rent, bills, books and fees. Many students are forced to work extra hours, apply for high-interest credit cards, or use payday loans. Ultimately, this is unsustainable. Over half of all community college dropouts are due to financial stress.

The Potential Impact

There are over 1 million students enrolled in New York, with half attending community college. Nationwide, that expands to over 20 million. Unfortunately, only 60% will graduate with a 4 year degree within 6 years. That number falls to a 35% graduation rate after 5 years for community colleges. With many citing financial pressures as the core cause, the need for alternative funding has never been greater.

Design Research Details

Discovery

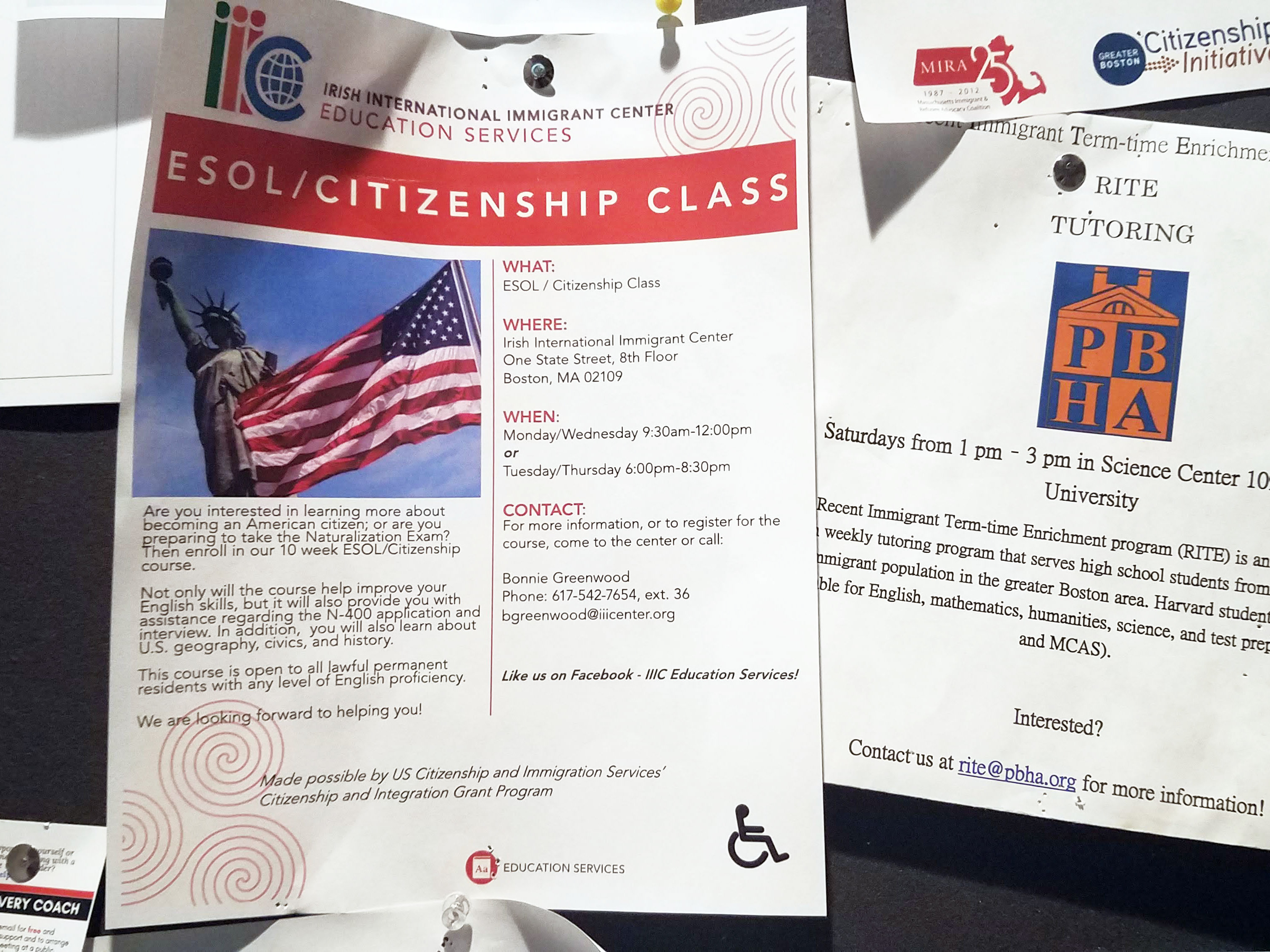

The team began by doing many weeks of ethnographic work with undocumented immigrants and interviews with the organizations supporting the community. One of many patterns that caught our attention was the lack of access to affordable loans for students of immigrant families who are forced to self-fund their education. All of the students we spoke with worked full-time to pay for school while also assisting their families. Even those who had a small amount of savings from high school jobs still hit financial obstacles that forced them to drop out or turn to high risk credit cards.

The team began by doing many weeks of ethnographic work with undocumented immigrants and interviews with the organizations supporting the community. One of many patterns that caught our attention was the lack of access to affordable loans for students of immigrant families who are forced to self-fund their education. All of the students we spoke with worked full-time to pay for school while also assisting their families. Even those who had a small amount of savings from high school jobs still hit financial obstacles that forced them to drop out or turn to high risk credit cards.

Validation

As we surveyed community colleges attended by students from immigrant families, we discovered that students who receive assistance also face similar financial obstacles. In fact, 52% of community school dropouts are due to financial pressure.

Immersion

Curious to learn why even those with aid were struggling, I set out to interview students in depth about their financial choices in relation to their overall college journey. Through these timeline workshops, I was able to clearly see patterns of when to reach out to students. To ensure a student understood the larger issue of unanticipated costs, we would want to target our marketing around the end of their freshmen year or later. Additionally in order provide the highest possible impact, we would want to reach a student before his junior year when many attempt risky solutions such as high interest credit cards or working more than they can balance with school. Lastly surveys and A/B testing validated a fairly even split of two very different types of students- those who actively budget and those who need loans now.

Ideation

After identifying our design challenge and speaking with many experts, our brainstorming led us to focus on lending circles as a potential solution for students without access to savings or traditional financial loans. Lending circles (aka tandas, cundinas or susus) are prevalent in the immigrant community amongst the first generation immigrants but not with the next generation who are primarily growing up in the US. Based on our targeted age range, we decided to prototype this traditional model as a modern day digital tool.

Iteration

With a solution in mind, we also worked on developing an identity that was welcoming and culturally agnostic. Ducks - like many birds - have symbolized security, strength and prosperity in many cultures. Since we were dealing in micro community loans, we chose to brand our tool “Duckling” which spoke to the size of the loans but also hinted at the potential for growth. Through landing page tests, I confirmed the appeal of this friendly mascot and visual style.

I also tested how to convey the value proposition to two distinct student mindsets - those who need cash now and those who want to earn more on their savings. Using prototype tests on various campuses, I iteratively refined the messaging to maximize immediate appeal, explain a complex financial model and address any barriers to conversion.